Best Payroll management software System has become an essential tool for businesses of all sizes, helping them manage employee payments, tax calculations, and compliance with regulatory requirements. With numerous options available in the market, choosing the best payroll management software system can be a daunting task. In this article, we will discuss the key features to look for in payroll software and present a list of the top 10 payroll management software systems.

Optimize your business with the best payroll management software system. Streamline payroll processes, calculate taxes effortlessly, and ensure compliance with user-friendly interfaces. Enjoy automated payroll runs, secure data handling, and seamless integration. Choose a solution that suits your company's needs, providing accuracy and efficiency in managing employee compensation. Elevate your payroll experience with cutting-edge technology for unparalleled results.

Choosing the right payroll software is crucial for the smooth and efficient management of your company's finances. With a plethora of options available in the market, it's essential to understand the key features that make a payroll system effective. Here are some key features to look for when selecting payroll software for your business:

Look for payroll software that automates the calculation of salaries, taxes, and other deductions. Automation not only saves time but also reduces the risk of errors associated with manual data entry.

Ensure that the payroll software stays updated with the latest tax regulations. A good payroll system should automatically calculate and deduct the correct amount of taxes, ensuring compliance with local, state, and federal tax laws.

Choose payroll software that seamlessly integrates with other business systems such as accounting software and human resources management tools. Integration streamlines the overall workflow and eliminates the need for manual data transfer between different platforms.

A user-friendly self-service portal allows employees to access their payroll information, view pay stubs, and manage personal details. This feature not only empowers employees but also reduces the administrative burden on HR personnel.

Every business has unique payroll requirements. Look for software that offers customization options to adapt to your company's specific needs. This may include custom pay codes, deduction categories, and reporting options.

Robust reporting capabilities are essential for gaining insights into payroll data. The software should generate detailed reports on salaries, taxes, and other relevant metrics, helping businesses make informed decisions.

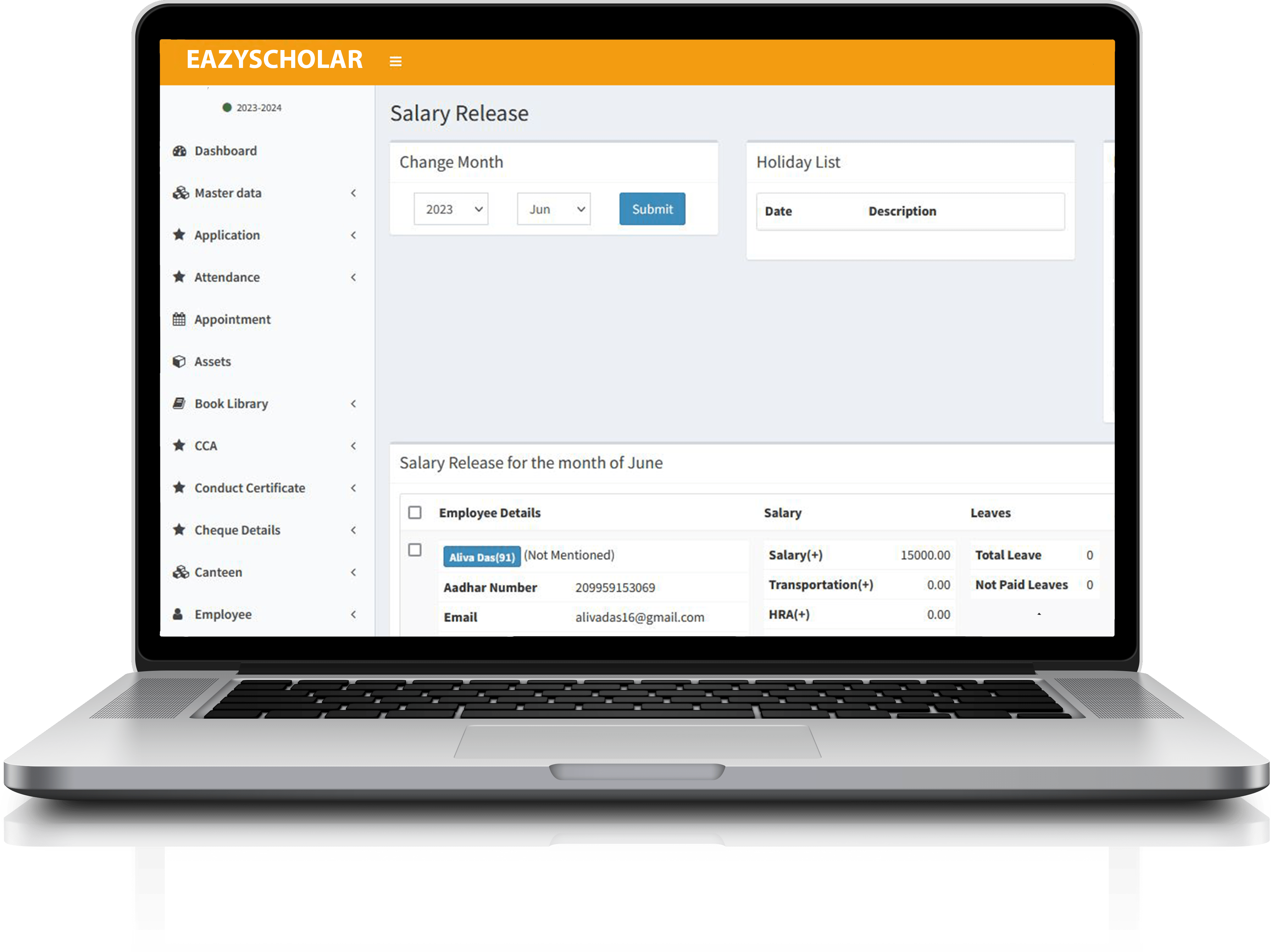

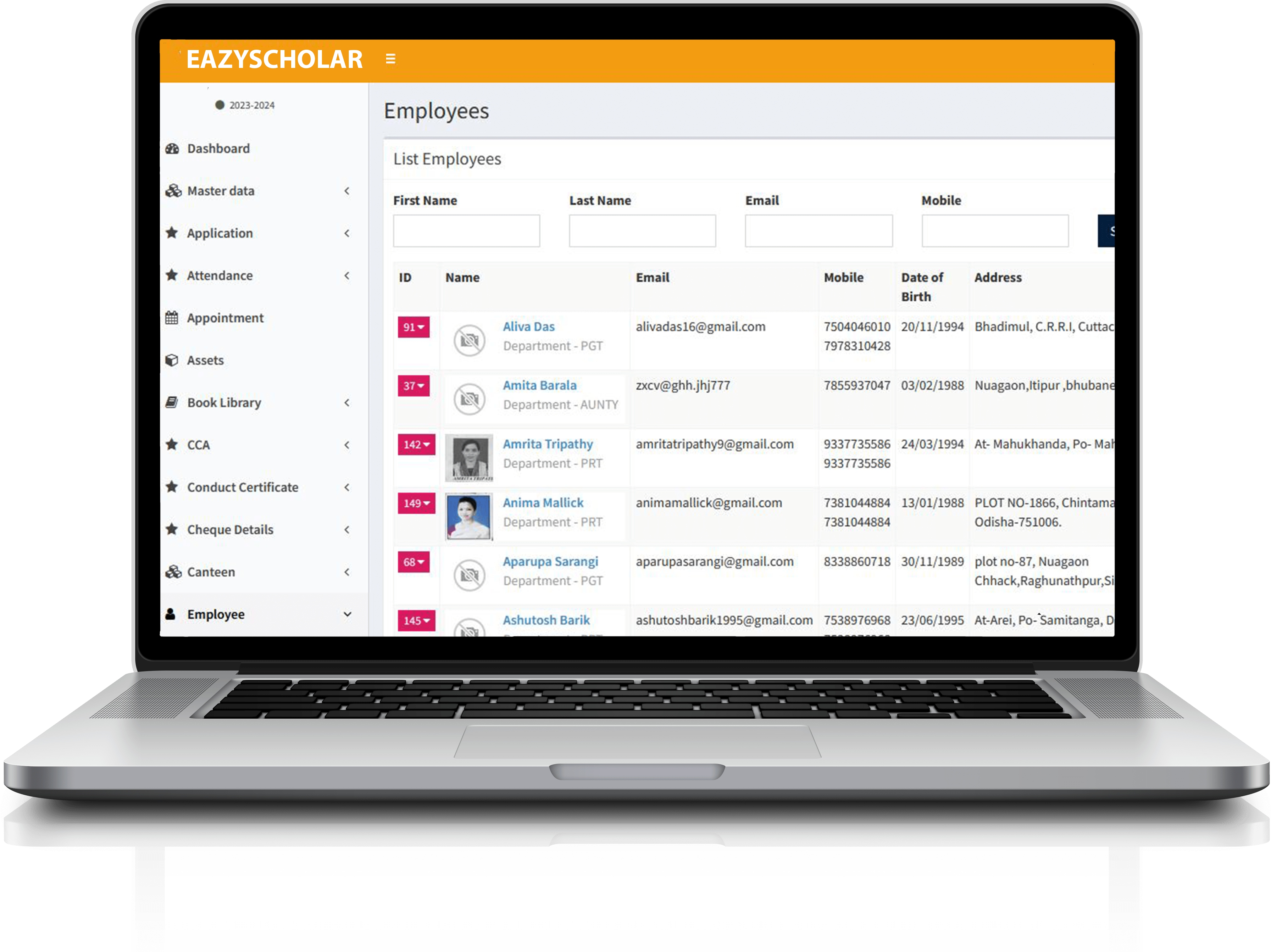

Eazyscholar ERP software simplifies payroll management with accuracy, scalability, and flexibility. It integrates with HR systems, generates reports, and provides comprehensive support and training for users.

Eazyscholar ERP software offers convenient and secure direct deposits for payroll, eliminating manual distribution. It also generates accurate and transparent payslips, fostering employee trust and compliance.

Eazyscholar ERP software ensures data security through encryption, access controls, backups, and compliance with regulations, promoting employee awareness for enhanced confidentiality.

Eazyscholar ERP software ensures enhanced data security in payroll management through robust encryption protocols, multi-factor authentication, and regular security updates and patches.

Eazyscholar ERP software provides customizable reports and analytics for payroll management, offering valuable insights and enabling informed decision-making and process optimization.

Eazyscholar ERP software seamlessly integrates with HR and accounting systems, automating data synchronization, streamlining employee onboarding/offboarding, and enabling efficient time and attendance tracking for accurate payroll management.

Payroll management ERP software is a computer-based system designed to automate and streamline the process of managing employee payroll, including calculating wages, deductions, and taxes, generating payslips, and maintaining records.

Some benefits of using payroll management ERP software include:

• Time and cost savings by automating manual tasks

• Accuracy in payroll calculations and tax deductions

• Compliance with legal and regulatory requirements

• Efficient record-keeping and reporting

• Improved data security and confidentiality

• Integration with other HR and accounting systems for seamless information flow.

Payroll management ERP software typically integrates with HR systems and captures relevant employee data such as attendance, time worked, and leave records. It uses this data to calculate wages, taxes, and deductions based on predefined rules and regulations. The software generates payslips, manages direct deposit, and provides reports for analysis and compliance purposes.

Yes, most payroll management ERP software offers customization options to accommodate an organization's specific requirements. You can configure settings related to payroll components, tax rules, leave policies, and other parameters to align the software with your business processes.

Yes, payroll management ERP software is designed to handle various complexities, such as different types of employee compensation (hourly, salaried, commission-based), multiple tax jurisdictions, deductions for benefits and retirement plans, and statutory compliance across regions or countries.

Payroll management ERP software typically provides robust security measures to protect sensitive employee data. These measures include data encryption, access controls, user authentication, and regular data backups. It is essential to choose a reputable software vendor and follow best practices for data security within your organization.

Yes, payroll management ERP software automates tax calculations based on predefined tax rules and rates. It can handle various tax scenarios, including income tax, social security contributions, healthcare taxes, and other statutory deductions.

Yes, payroll management ERP software offers reporting capabilities. It can generate various reports, such as payroll summaries, employee earnings statements, tax reports, and year-end reports for auditing and compliance purposes. These reports provide valuable insights into payroll costs and help in decision-making processes.

Yes, payroll management ERP software can integrate with other systems like accounting systems, time and attendance systems, and employee self-service portals. Integration allows seamless data flow between systems, eliminating duplicate data entry and improving overall efficiency.

Software vendors usually provide training and support resources to help users understand and maximize the software's capabilities. This may include user manuals, online documentation, video tutorials, and customer support channels such as email, phone, or live chat. Some vendors also offer on-site training or webinars to assist with implementation and usage.